Pie Is The Free Self-Assessment App Self-Employed Individuals Need, Offering An Easy Way

Pie Is The Free Self-Assessment App Self-Employed Individuals Need, Offering An Easy Way To Manage Taxes Without Stress Or Confusion

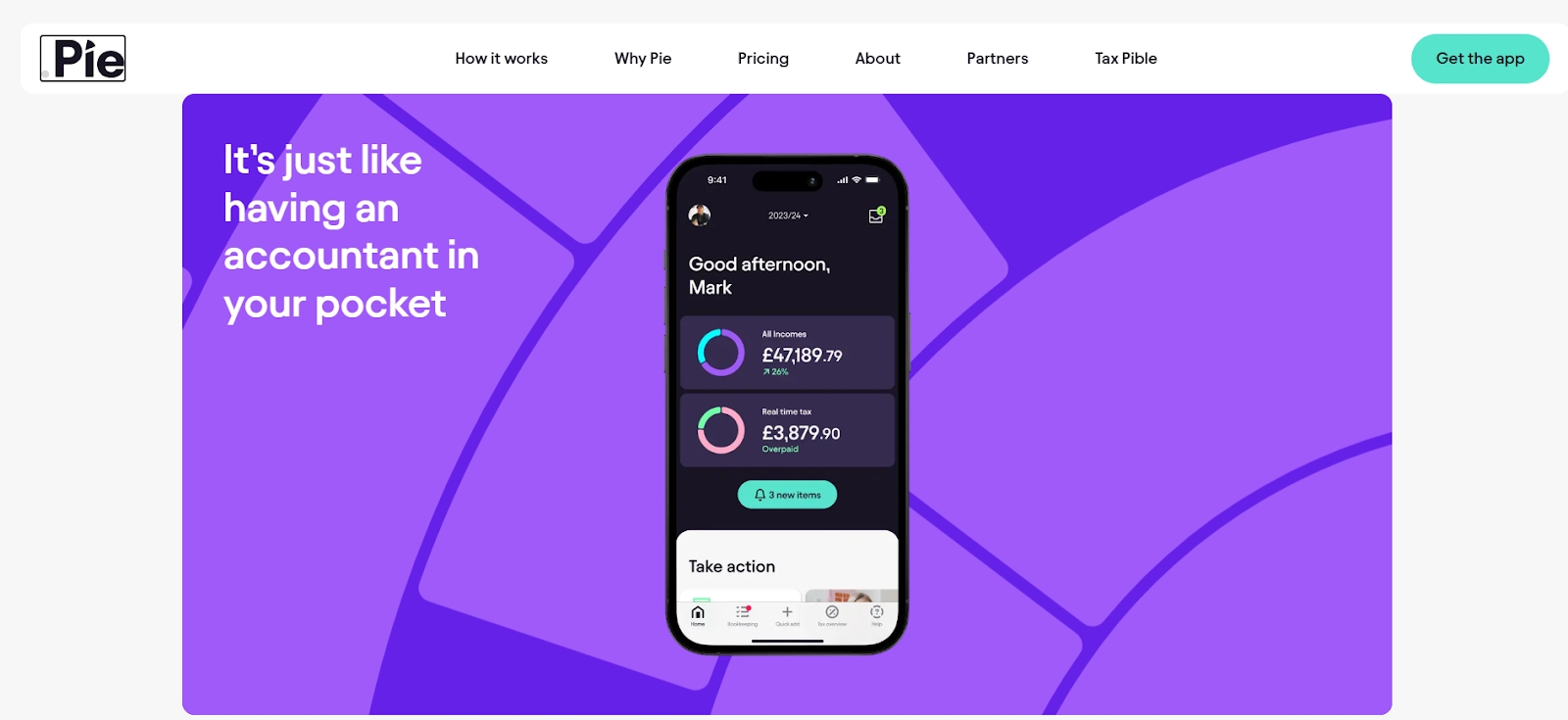

If you’re self-employed, then you know the dread that tax season can bring. The piles of paperwork, the constant worry about getting your figures right, and the looming deadlines can make tax season feel like an impossible task. Enter Pie – the free self-assessment app that’s changing the game for self-employed people across the UK. Forget about scrambling to make sense of your income and expenses come the end of the year, Pie gives you a hassle-free way to manage your taxes every step of the way, without the stress.

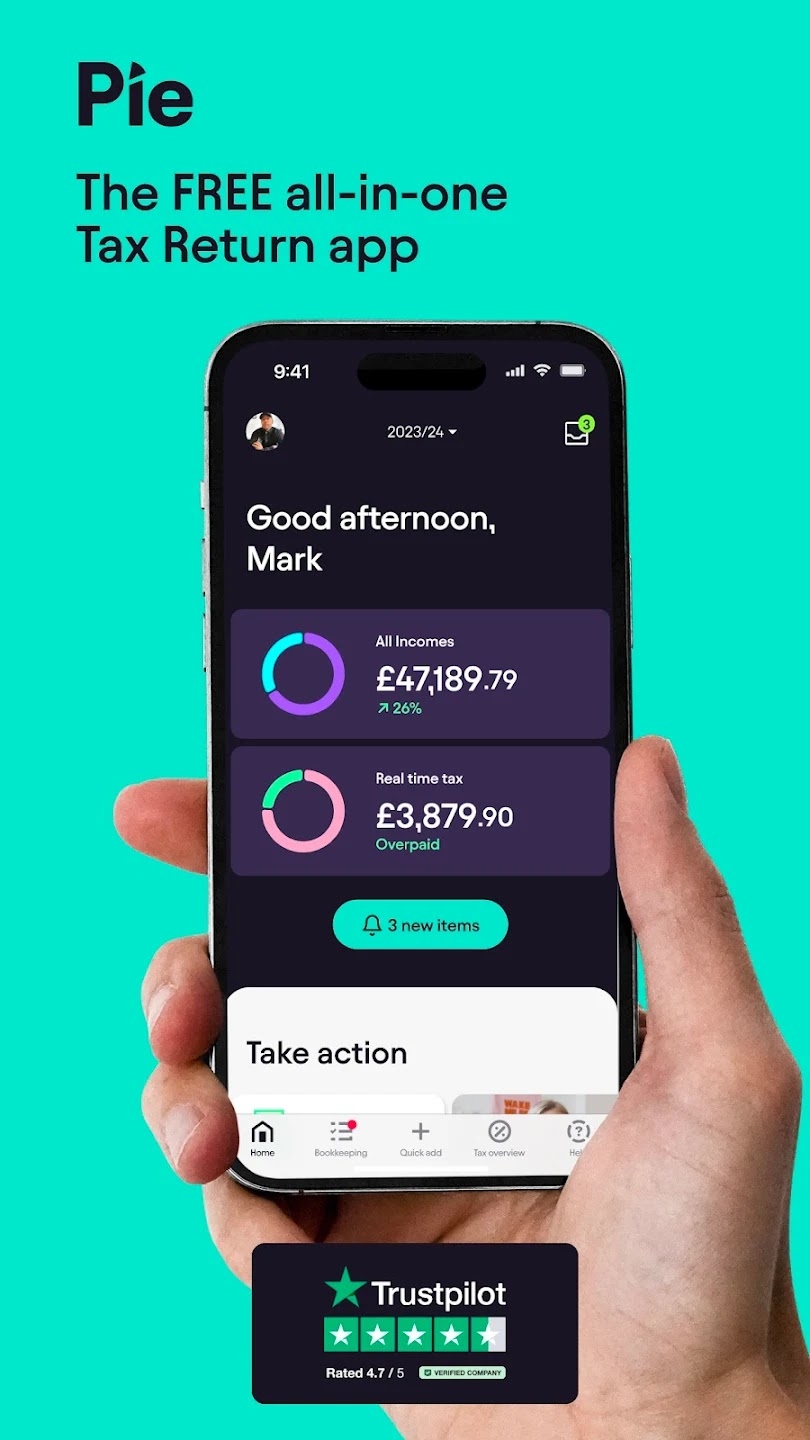

One of the best things about Pie is that it’s free to use for self-assessment. That means you can keep track of your earnings, expenses, and tax obligations throughout the year without ever having to pay a penny in your dedicated Tax Calculator. The app is designed to simplify tax management for freelancers, sole traders, and anyone who’s self-employed, so you won’t need to waste any time getting tangled in complicated forms or confusing jargon. With Pie, everything is laid out clearly, so you can see exactly where you stand when it comes to your tax situation at any given moment.

The free features don’t stop there either. Pie lets you submit your self-assessment tax return directly to HMRC, without having to pay for a costly accountant. This is one of the most impressive aspects of Pie – it takes care of all the paperwork for you, submitting everything directly to HMRC so you don’t have to worry about missing a deadline or making a mistake. And because the app keeps everything digital and up to date, you don’t have to deal with paper forms or worry about losing important documents along the way. It’s all handled for you with just a few taps.

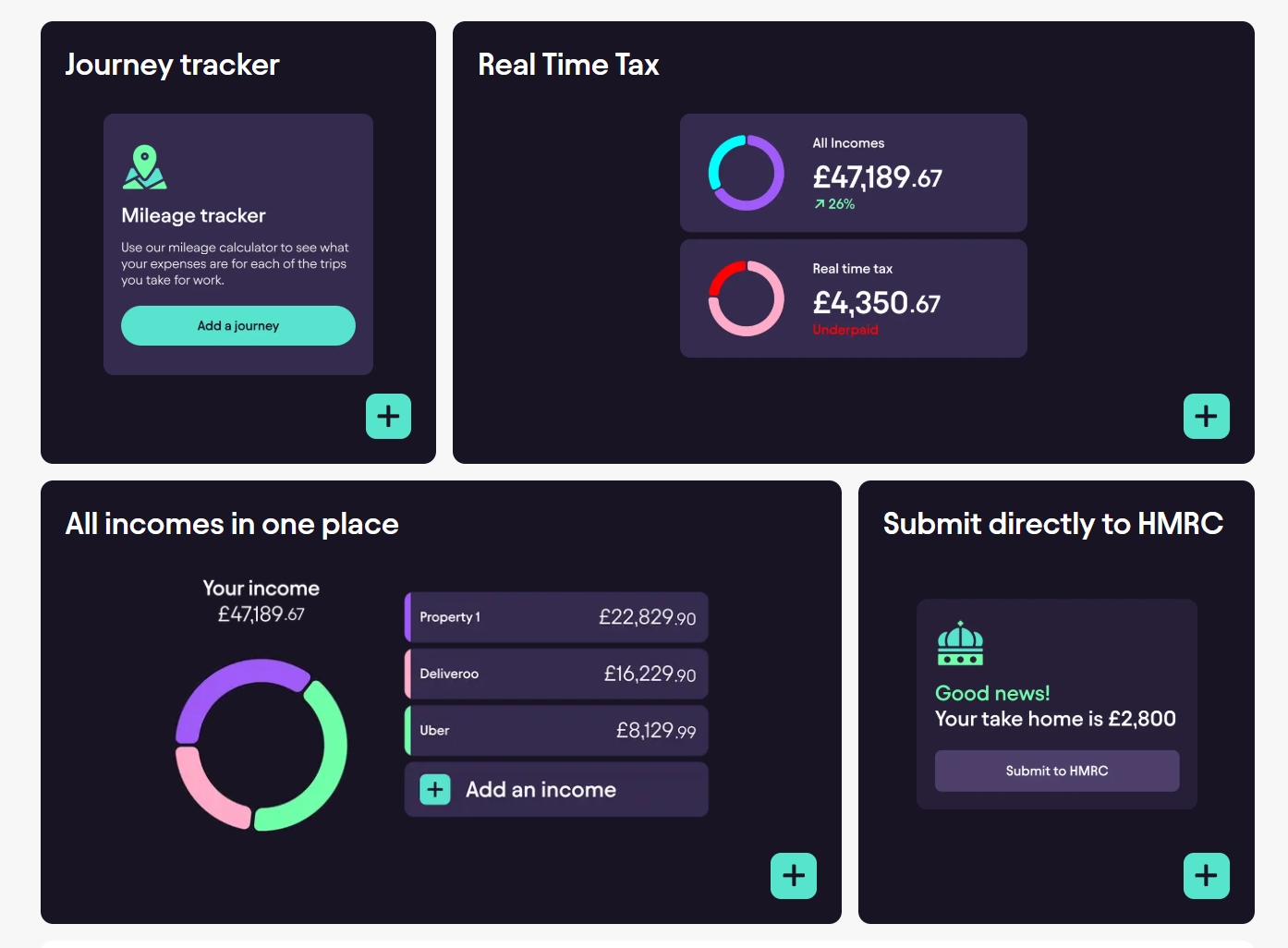

But one of the features that really makes Pie stand out is its real-time tax figures. As a self-employed person, your income can fluctuate from month to month, which makes it difficult to know exactly how much tax you’ll owe. Pie takes away the guesswork by calculating your tax obligations in real time. You’ll always know how much tax you’re liable for at any given moment, and if you’re on track to meet your obligations. This means you can avoid any nasty surprises come the end of the year – no more scrambling at the last minute to come up with the funds to cover your tax bill.

Even though Pie is free to use for submitting your self-assessment, the app also offers some affordable premium features that go above and beyond what a basic self-assessment tool can do. One of the biggest advantages of Pie is that its premium add-ons are incredibly cost-effective when compared to traditional services. If you’ve ever hired an accountant or used other paid software, you know how expensive these services can get. Pie makes sure you’re not left out of pocket, with options that are far more affordable than hiring a professional accountant to handle everything for you. It’s a budget-friendly way to get the tax help you need without breaking the bank.

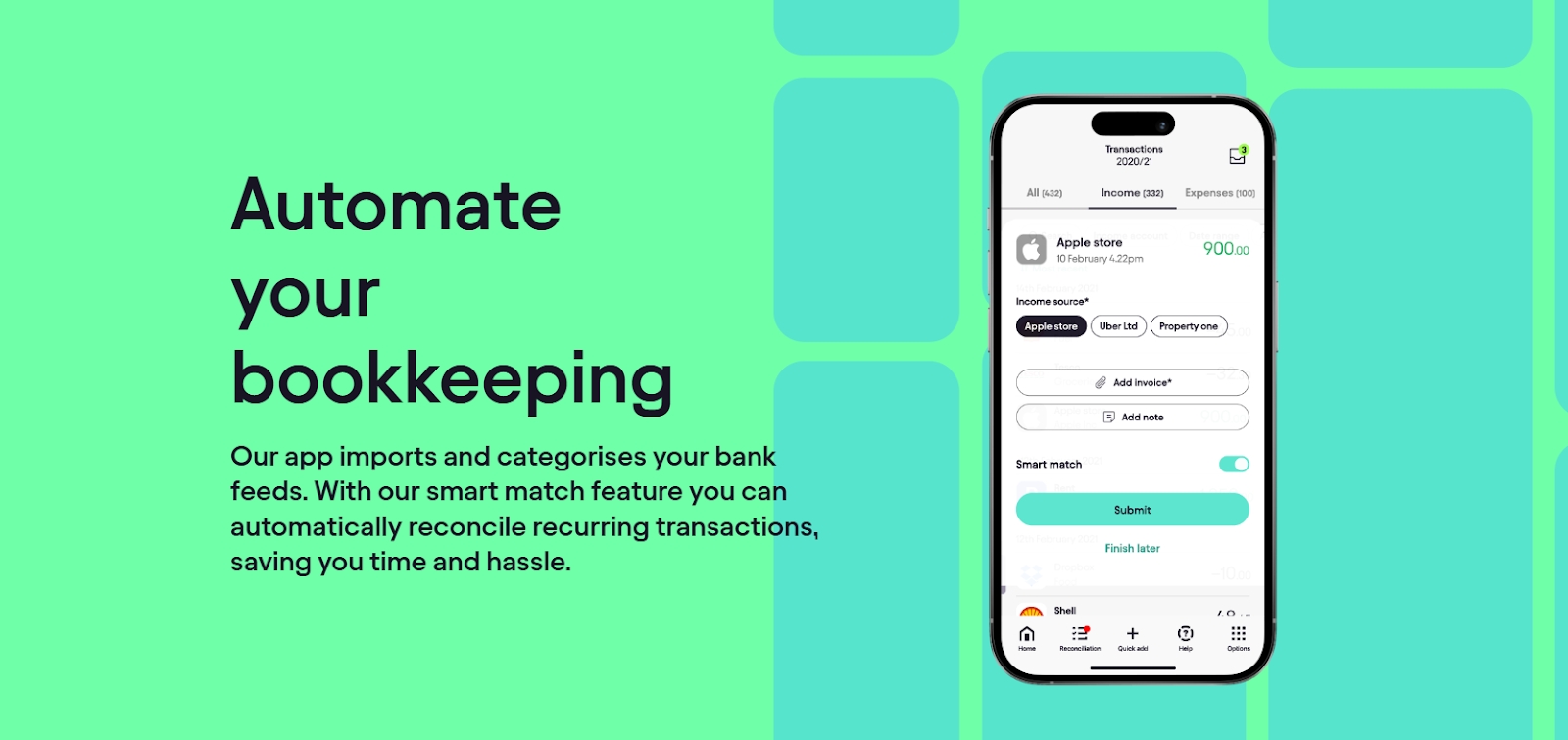

The premium features include things like automatic receipt reconciliation, where the app helps you categorise and track your expenses effortlessly. As a self-employed person, you’re likely juggling many different expenses, from tools and equipment to office supplies or travel costs. Pie’s receipt reconciliation feature makes sure nothing slips through the cracks, so you can always stay on top of your financial records. Plus, Pie even integrates with your bank account, so your transactions are automatically categorised for you, saving you time and effort on bookkeeping.

Another feature that sets Pie apart is its ability to handle multiple income streams. Whether you’re running a side hustle in addition to your main business, or you have income from a few different sources, Pie makes it easy to keep everything organised. Instead of trying to keep track of multiple spreadsheets or relying on your memory, Pie pulls all of your income data into one place and automatically calculates how much tax you owe based on the various sources. This is especially handy for self-employed people who don’t just rely on one income stream but have to manage several throughout the year.

Pie also offers tailored advice and tips to help self-employed users optimise their tax situation. The app is not just about calculations and submissions, but also about guiding you through the whole process of tax management. If you’ve ever felt unsure about what expenses you can claim or how to maximise your tax savings, Pie’s in-app advice gives you the information you need to make smart decisions. You’ll have access to helpful tips and advice specific to your industry, whether you’re a freelancer, a sole trader, or anything in between.

The overall design of the app is incredibly user-friendly, which is another reason why it’s such a great tool for self-employed individuals. If you’re not a numbers person, Pie makes everything as simple as possible, breaking down your tax status in a way that’s easy to understand. You won’t have to deal with complicated charts or unclear tax jargon – it’s all presented in a straightforward, easy-to-read format. This makes managing your taxes less stressful and ensures you have everything you need in one place.

What’s more, Pie is always evolving to meet the needs of its users. The app is regularly updated with new features and improvements, making sure it stays on top of the latest tax regulations. This means that you won’t need to worry about outdated software or missing out on crucial changes to tax law. Pie is built to grow with you, ensuring you have access to the most up-to-date tools to manage your taxes efficiently and accurately.

In the end, Pie is truly the self-assessment app that every self-employed person should have on their phone. With its free features, real-time tax figures, and easy HMRC submissions, you can handle your tax affairs without the stress and expense of hiring an accountant. And when you want to take things to the next level, Pie’s premium add-ons provide even more support at a fraction of the cost of traditional services. Whether you’re just starting out as a freelancer or you’ve been self-employed for years, Pie has everything you need to manage your taxes with ease, confidence, and a bit of extra cash in your pocket.

Last updated